Customs Clearance

What is Customs Clearance?

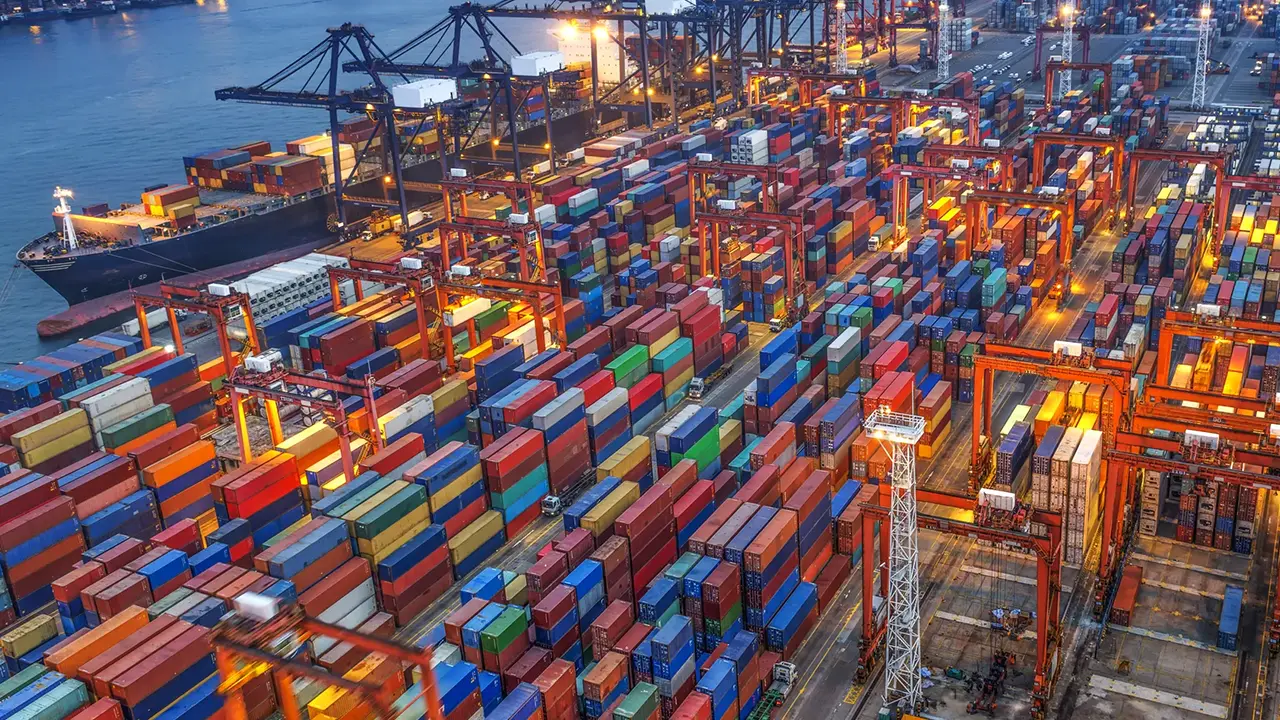

Customs clearance is a mandatory process that goods must go through whenever they enter or leave a country. This process ensures that the correct taxes and duties are paid and that regulations are followed, keeping global trade flowing smoothly. The customs clearance process has four main stages:

- Declaration of Goods: Goods are declared to the customs authority, providing details such as their value, origin, and destination. Supporting documents, like invoices or bills of lading, may also be required.

- Calculation of Duties and Taxes: Based on the documentation, customs authorities calculate the amount to be paid in duties and taxes.

- Issuance of Clearance Confirmation: If the customs declaration meets all requirements and all necessary payments have been made, the shipper receives documentation confirming the goods are legally cleared to cross the border.

- Release of Goods: After clearance by customs authorities, the goods are allowed to move forward for transportation or delivery.

What is a Customs Declaration?

A customs declaration is a document completed as part of the mandatory customs clearance process. It is usually filed electronically and includes key information about goods crossing the customs border during import/export. If the declaration does not meet customs requirements, goods may be held at the border for inspection or until additional information is provided. To avoid such delays, a specialist customs broker is often used to complete and submit the customs declaration.

Who Pays Customs Charges?

Technically, customs duties and taxes can be paid by either the buyer or the seller. However, in commercial shipping, it is almost always the importer or consignee who pays these charges—that is, the person bringing goods into a country from abroad.

What is a Customs Broker?

A customs broker is an individual or company that simplifies the customs clearance process when goods are imported or exported across international borders. They ensure that items reach their destination without unnecessary delays or charges. A customs broker handles administrative tasks related to customs clearance, such as submitting the correct customs declaration and paying any duties and taxes on behalf of the importer.

What are Customs Clearance Services?

Due to the complexity of customs regulations, many organizations enlist a customs broker to manage this part of their business operations and prevent delays or disruptions. Customs clearance services can include:

- Preparing and reviewing customs documentation, identifying and correcting errors before submission.

- Ensuring compliance with customs regulations in the destination country.

- Identifying trade agreements that could reduce duties and taxes.

- Paying customs duties and taxes on behalf of the importer.

- Communicating with authorities to resolve any issues.

- Providing post-clearance support, such as compliance audits and record-keeping.